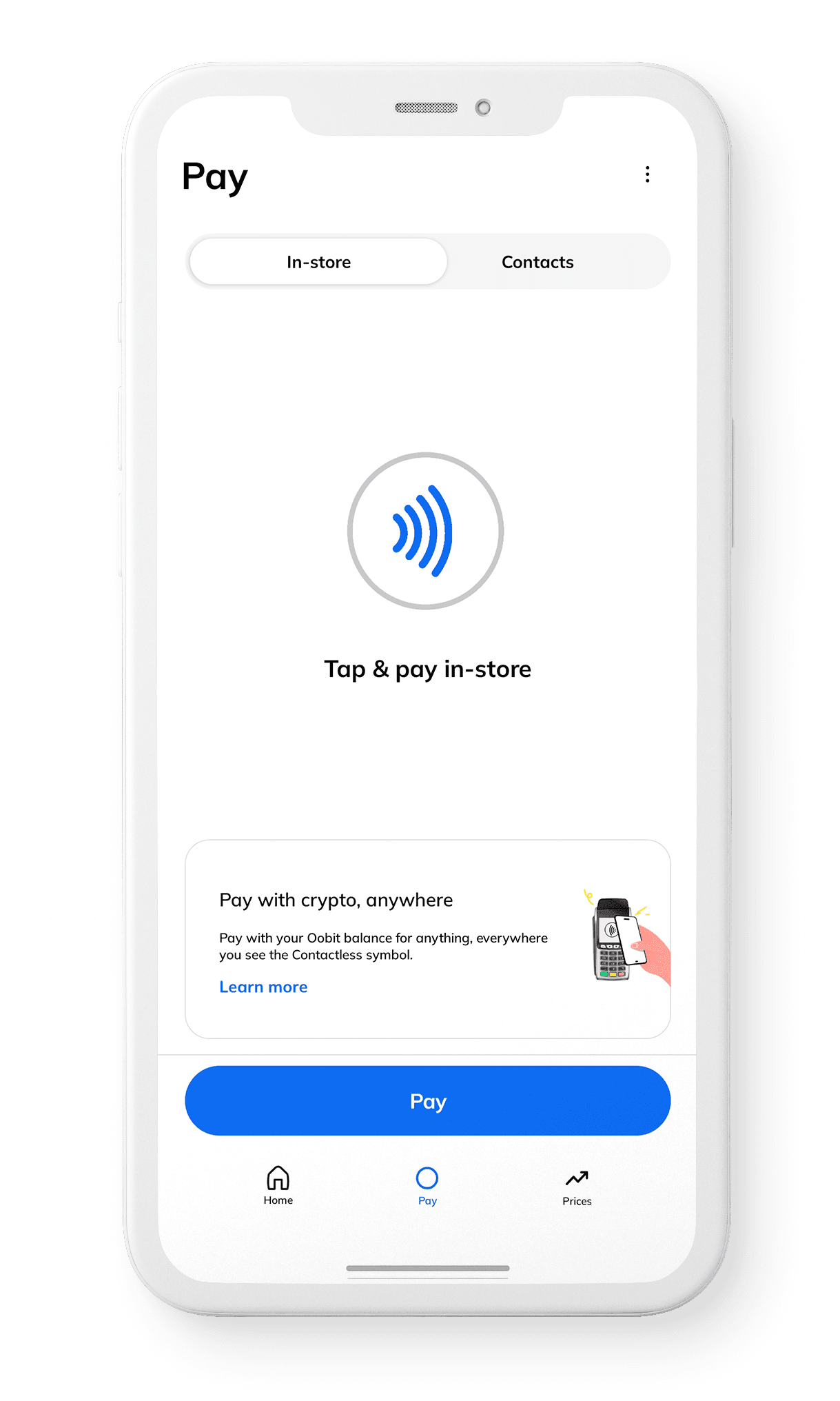

Mobile wallet for offline crypto payments.

Industry:

Finance & banking (crypto)

Project:

Oobit

Team:

1 iOS dev

1 Android dev

1 QA specialist

1 Project manager

Duration of project:

Started in 2021 (ongoing)

Country:

Israel

Tech stack:

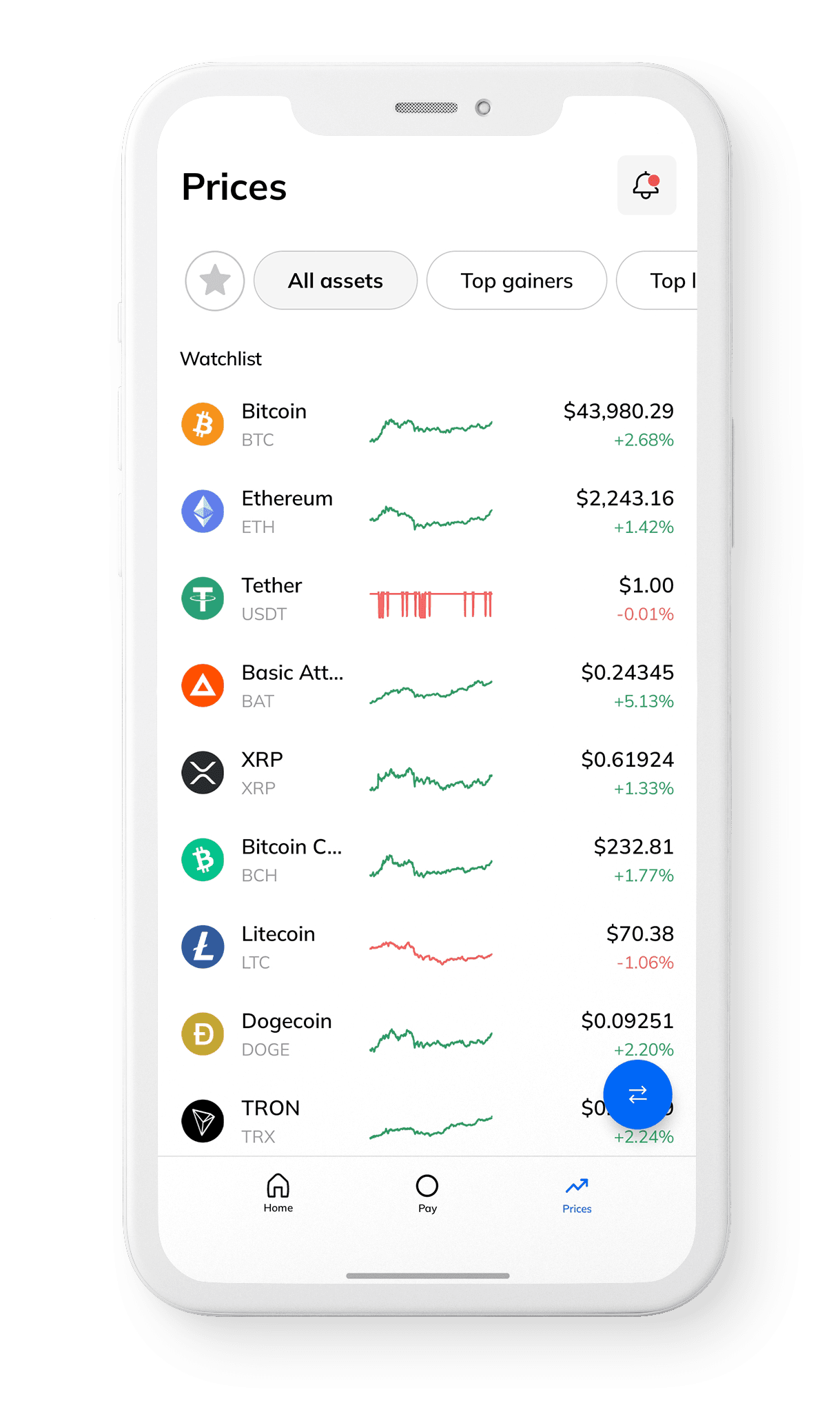

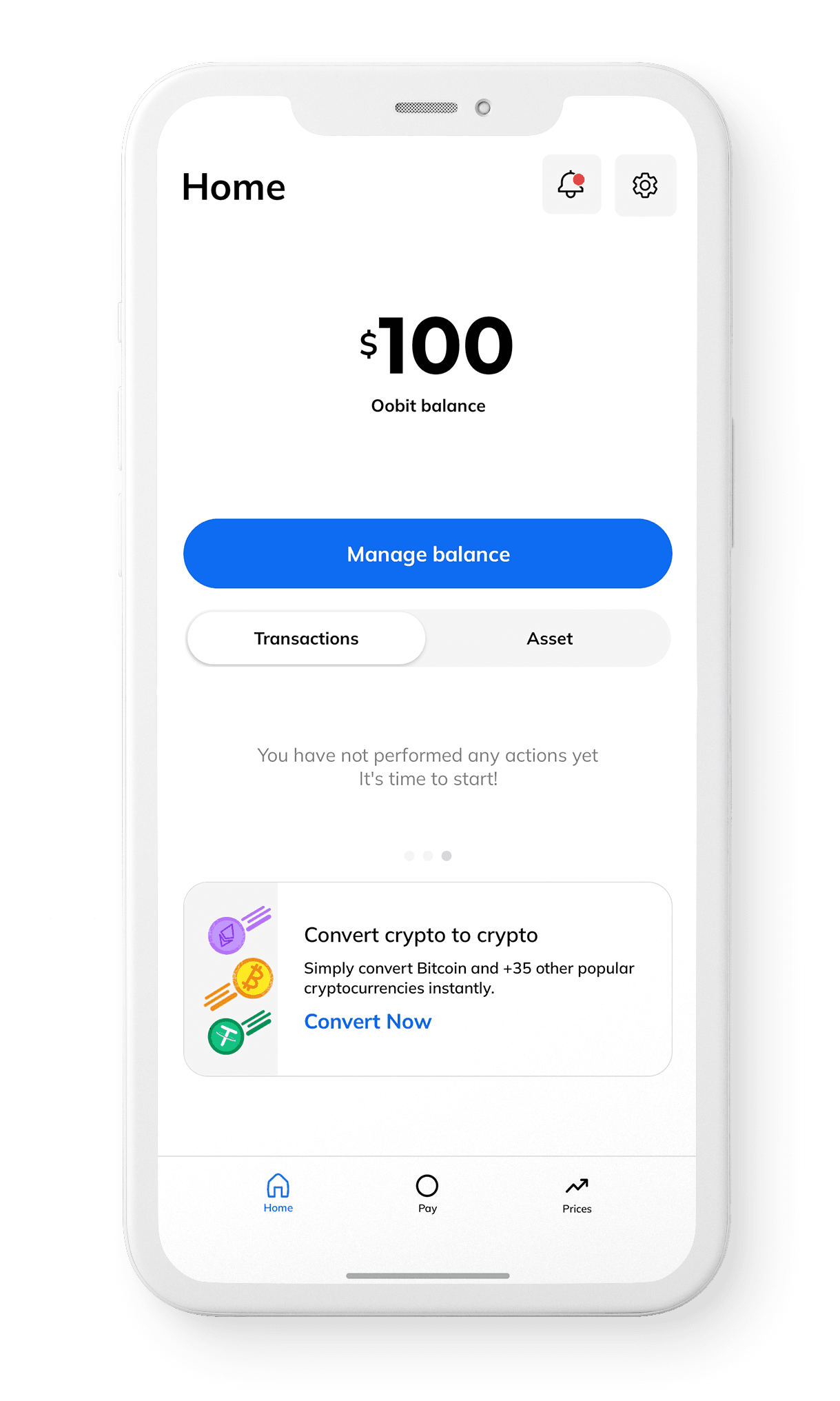

Oobit is an app where crypto holders can Tap & Pay at any store anywhere Visa and Mastercard are accepted, just like using Apple Pay®.

Client value

to end user.

Anyone who holds cryptocurrency now can buy goods and services at offline stores. Using an easy-to-use mobile app and NFC technology, users of Oobit can easily pay at any location Visa and Mastercard are accepted.

Risks.

Regulatory compliance

The mobile app's global accessibility requires specific crypto licenses in various countries. To address this risk, we worked with third-party partners experienced in legal and regulatory compliance.

Market and innovation

Crypto payments in traditional stores are new and risky to develop. To ensure smoother development and launch, we have formed strategic partnerships with third party organisations that can handle the legal and financial aspects.

Challenges.

Crypto-to-fiat conversion

A key challenge for the infrastructure has been developing a robust system for converting cryptocurrencies into traditional fiat currencies like the Euro and U.S. Dollar. We have successfully addressed this challenge over a three-month period, ensuring a reliable conversion process.

Development phases.

Team formation: We assembled a dedicated team consisting of specialists with specific roles: 1 iOS developer, 1 Android developer, 1 QA specialist, 1 Project Manager.

Requirements gathering: A thorough requirements gathering phase. We collaborated closely with the client to define project objectives, user stories, and acceptance criteria.

Technology selection: After careful consideration, Native Android (Kotlin) and Native iOS (Swift) were chosen as the development languages due to their close integration with device capabilities, which is crucial for implementing features like NFC and secure payments.

Mobile development: The development team begins building the mobile application simultaneously for iOS and Android platforms. Development sprints are organized to work on specific features and functionalities.

User feedback: Gathered through Agile/Scrum events like DEMOs, where all stakeholders were invited to view and provide feedback on new functionalities and features.

Integration with financial partner: During the development of the mobile app, we have worked to ensure seamless integration with the financial partner's systems to provide secure and convenient payment solutions for the stores.

Source code management: A robust source code management and version control system was implemented to facilitate collaboration and maintain code integrity.

Quality assurance: Unit testing, integration testing, and user acceptance testing to identify and address any issues promptly.

Security testing: To ensure the highest level of security, we collaborated with a third-party for regular security testing — involving penetration testing and vulnerability assessments to fortify the system's security.

Staging and testing environments: Firebase is leveraged for Dev and Test environments, enabling quick sharing of builds and providing valuable analytics and crash information.

Deploy process: We employed a semi-automated deployment process, covering multiple environments including Development, Testing, and Production.

Production rollout: The final production rollout is executed through the native app stores of Apple and Google, ensuring a seamless and controlled release to end-users.

Compliance: Throughout the deployment phase, we ensured compliance with relevant industry standards and regulations, particularly regarding financial transactions and data security.

Client collaboration: We maintain an ongoing collaboration with the client's Product Owner, who leads the way in prioritizing and approving system features.

Monitoring and optimization: Post-deployment, the system is continuously monitored for performance and user feedback. Regular updates and optimizations are made to enhance the user experience and system efficiency.

Performance & optimization.

Converter optimization: To optimize efficiency and resource usage, the team worked on improving the efficiency of the currency converter, streamlining communication protocols, and optimizing payment processing to reduce delays.

UX features: A tutorial was implemented at the beginning of the application to assist users in understanding how to use the app effectively, improving usability for new users.

Automation: It was leveraged for unit testing, integration testing, and regression testing — identifying and addressing bugs early in the development process, reducing testing costs and improving overall software quality.

CI/CD Workflows: Established using Firebase for Dev and Test environments and Apple/Google Play stores for production deployments — enhancing project efficiency by automating the build, testing, and deployment processes

Scalability: It can easily scale to accommodate future feature development. The architecture allows for seamless integration of additional functionalities as the product grows.

Results.

User adoption rate

10,000

active users

The project indicates a positive user adoption rate.

Customer response

50,000

engaged

Customers have engaged with the system showing a significant level of interest and response.

Cryptocurrency integration

+21 cryptocurrencies

cryptocurrencies

We integrated a diversity of supported cryptocurrency

Lessons.

Have an idea?

Related case studies.

Educational app & platform for parents

EdTech

- IT Consulting

- Digital Transformation

- Agile Development

Online pet marketplace on desktop

Ecommerce

- IT Consulting

- Cloud engineering

- Staff Augmentation

- CTO as a Service

Digital optical showroom application

Ecommerce

- Digital Transformation

- IT Consulting

- Business Analysis

- CTO as a Service

Postal service digital transformation

Egovernment

- Digital Transformation

- Business Analysis

- Agile Development

- Cloud engineering