Current

26 Mar 2024

Fintech is changing the future of financial services

Imagine transferring money to a friend in another country in seconds, without hefty fees or long waiting times. This isn't a glimpse into the future; it's the reality of FinTech today. Financial technology, or FinTech, is revolutionizing the way we manage, invest, and spend money, making transactions smoother, faster, and more secure. From mobile payments to blockchain technology fintech is bringing financial services into the digital age and making life easier for businesses and people around the world.

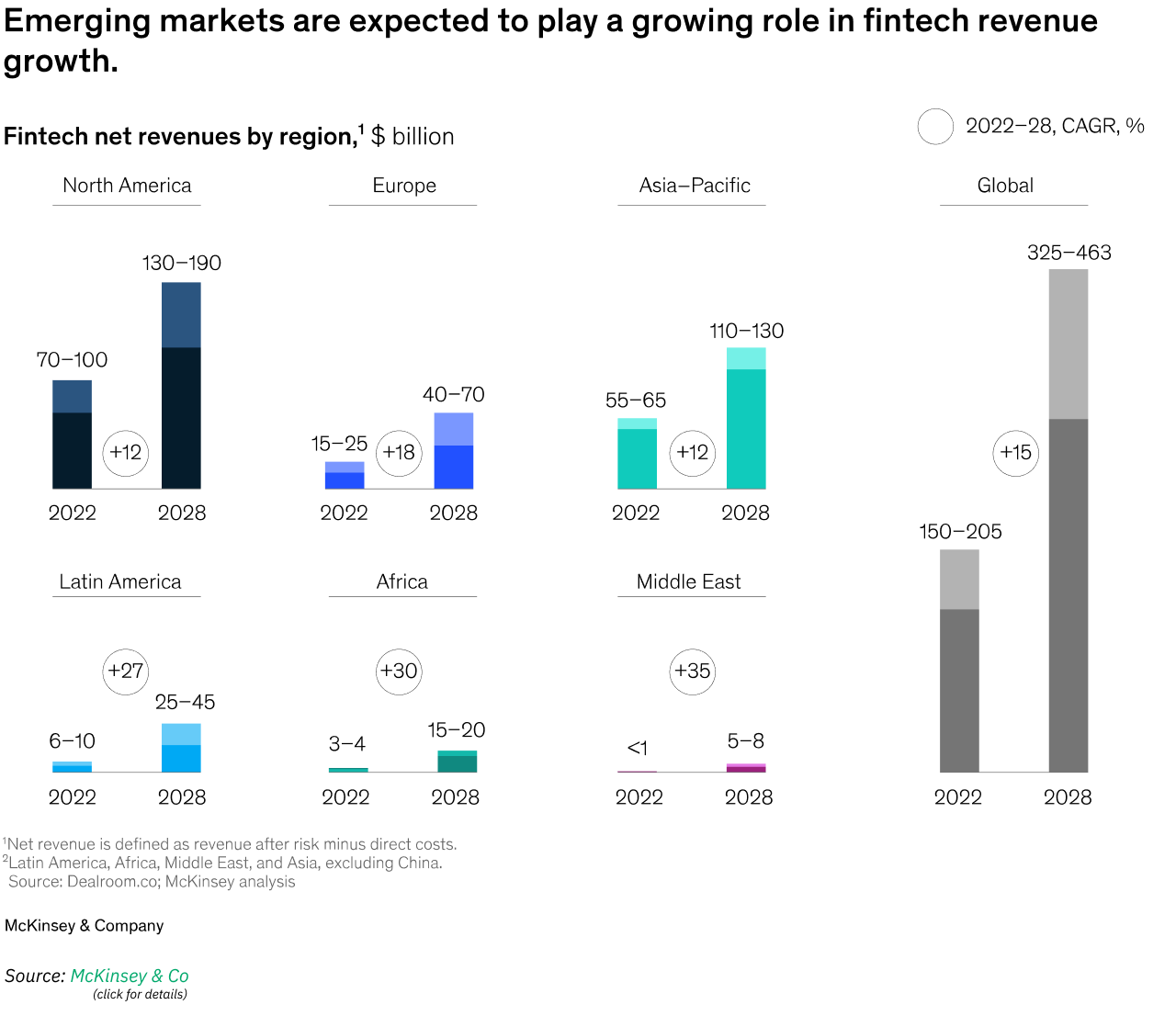

Let's look at the recent numbers in the industry to get a better view upon what FinTech is all about. Since 2022, financial services companies have begun to transform the financial industry in significant ways, generating around 5% of the total revenue of the global banking sector. In monetary terms, this translates into a fairly substantial $150 billion and $205 billion. But that's just the beginning. Predictions say this number will more than double by 2028. That's right, FinTech is growing at a pace much quicker than traditional banking, proving it's not just a passing trend but a major shift in how we think about and manage financial services.

Now, if you look beyond these rather impressive figures, you'll see that it actually reflects a collective, broader move towards digitisation, giving businesses the tools they need to keep up with current market demands. And fintech is at the forefront of this change, offering solutions that are faster, more convenient and often more cost-effective than traditional options.

*Keep reading to learn how to navigate this digital revolution and leverage FinTech to not just compete, but excel in the global financial services landscape.

Financial technology changes the game

FinTech, short for financial technology, is revolutionising the way we manage our money, offering a seamless experience that goes far beyond traditional banking methods. It has evolved significantly, from the introduction of credit cards and ATMs to today's advanced technologies such as mobile payments, internet banking, decentralised finance and open banking.

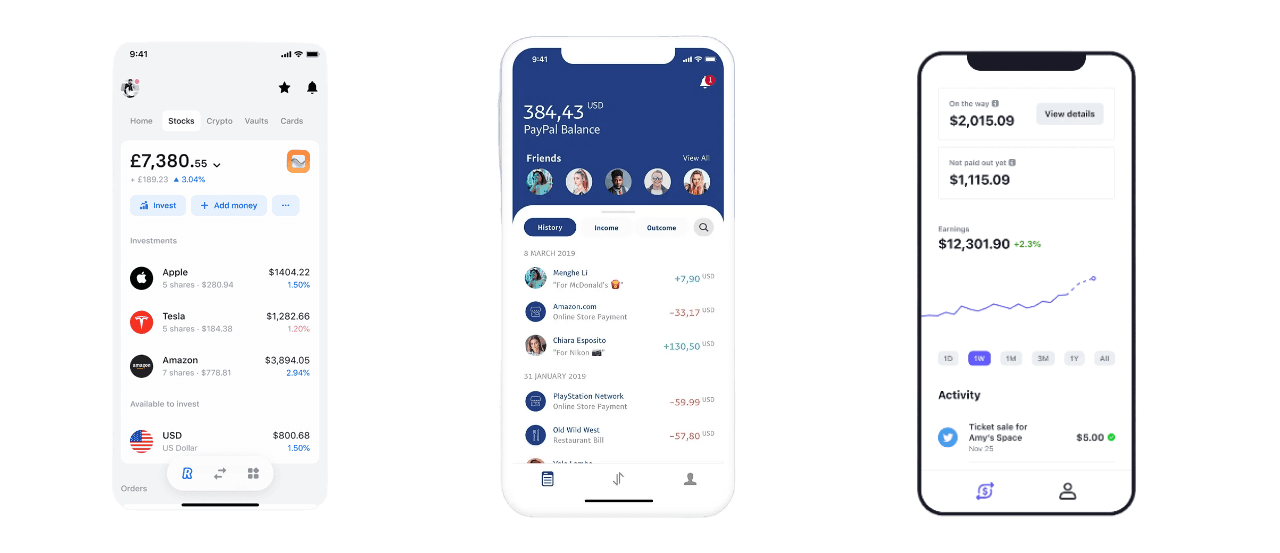

A key development in fintech has been the widespread adoption of digital wallets, now preferred by 53% of consumers over traditional payment methods. This shift towards a digital-first financial experience is largely due to the integration of artificial intelligence (AI) and machine learning (ML). Both of these technologies enhance the security and ease of financial transactions by improving fraud detection, credit scoring and customer service.

The days of waiting in line at the bank are gone. FinTech has simplified complex financial tasks, allowing us to manage our finances with just a few taps on our smartphones. This shift towards direct consumer services became more pronounced around 2018, transforming financial education, retail shopping, and making investment opportunities more accessible.

By 2021, the World Bank's Global Findex Database revealed that worldwide account ownership had reached 76% of the global population, underscoring the widespread adoption and impact of financial services, including FinTech. Companies like Square and PayPal have streamlined transactions for individuals and small businesses, while platforms like Robinhood have democratized the stock market.

For finance professionals, the FinTech wave introduces a new mindset about money, leveraging innovative apps and technologies like blockchain for secure transactions. This digital shift means money moves faster and more securely, offering ripe investment opportunities. As FinTech companies grow and capture more market share, they're proving to be a profitable venture, potentially shifting significant revenue from traditional banks.

Why should you care? For anyone looking to get into this space, whether investing in it or using these services, the key is to understand the power of technology in finance. There's a lot of potential to make things better for everyone, but it's also important to move carefully and think about the long term.

Financial services are getting better with technology

Technology is changing the game for financial companies, from small startups to big banks, helping them grow and offer their services to more people around the world. A mix of old-school banks and new FinTech companies are using tech like digital wallets, payment platforms, and blockchain to stay ahead. This mix is good for growth, making the financial world more digital and connected.

One big way technology is helping is by reaching new markets.

Companies can now serve customers not just in their own country but globally, thanks to the internet and cloud computing. For instance, Revolut used an agile, technology-driven approach, which allowed for rapid scaling across borders. By leveraging cloud computing and an API-first strategy, Revolut was able to offer a seamless banking experience to over 15 million customers worldwide by 2021, highlighting the growing reach and impact of fintech in accessible global banking.

Knowing what customers want is another big win.

Businesses are using AI and Data to figure out exactly what their customers want, helping them tailor their services and improve their products. According to a McKinsey survey, more and more people (88%) see the technology of APIs (Application Programming Interfaces) as crucial. APIs are getting a lot of attention, especially from banks, because they help bring new tech to life, make services easier to access, and support fresh ideas like banking as a service. With banks putting about 14% of their tech budget into APIs, it's clear they play a key role. These APIs make it possible to use the insights gained from AI to offer customers more personalized and enhanced services directly.

Then there's the paperwork—or rather, the lack of it now.

Technology means less filling out forms by hand and more quick, digital processes. This saves time and money, making operations smoother and customers happier.

Speaking of happy customers, they don't like waiting.

Waiting for payments is a thing of the past. With digital transactions growing by 20% every year, you can adapt to run your business faster too. Digital transactions is the kind of efficiency you need to operate in a more effective way - it's what today's customers expect.

Security is also crucial.

With all the news about data breaches, know that investing in tech like blockchain puts your business ahead in security. It's about making sure your customers' money and their data are safe, building trust that's crucial in today's market.

Lastly, technology opens up new possibilities for businesses.

New ways of handling money are emerging all the time. Keeping up with these innovations can give your business an edge, whether it's using digital currencies or finding new funding options like crowdfunding. With the right technology, the possibilities for growth are endless.

Ok, ok... technology is good and all, but it's pretty complex

Sure, integrating new technologies comes with the challenges that come with such a big change. From keeping up with changing legislation to protecting your customers' data, there's a lot to think about. In this section, we'll take you through some of the common roadblocks business owners face when adopting technology in their financial services. We'll also share some tips and data to help you overcome these challenges smarter.

The legal landscape is always changing

Laws around digital finance are always evolving. For example, GDPR in Europe has set a new standard for data protection, impacting businesses worldwide. Staying updated and compliant is crucial not just to avoid fines but to remain competitive and trustworthy.

Cyber threats are another big concern

Cybercrime costed the financial world $6 trillion a year by 2021. Remember, even a single data breach can cost not only money, but also your customers' trust. So, investing in top-notch security systems and employee training can really go a long way to protecting a business from these threats.

The cost of upgrading technology can be high

Yes—but it's an investment into a business's future. The right tech can make operations smoother and more efficient, saving money in the long run. It's like upgrading to a better engine for your car; it runs faster and saves on fuel. Plus, there are companies out there that can help you figure out if the cost today will pay off with better performance tomorrow.

A skills gap can emerge as technology advances.

As technology advances, so does the need for skilled professionals. Creating a culture of learning and upskilling can keep your team up-to-date with the latest technological advancements.

Privacy is paramount

With great data comes great responsibility—ensuring customer privacy is essential. Ensuring customer privacy is critical, especially as data breaches can lead to significant trust issues and financial penalties.

What can you do about it?

For businesses looking to grow through FinTech, it’s important to approach this transformation thoughtfully. Here's a simplified guide on leveraging FinTech effectively:

Understand Your Goals: Start by figuring out what you want to achieve with FinTech. This could be improving your services, making your operations more efficient, or expanding your reach. Having clear goals helps you make the right tech decisions.

Research the Market: It’s crucial to know the FinTech landscape and what your competitors are doing. Understanding the latest trends and what your customers expect can help you spot opportunities to stand out.

Select the Right Technologies: Once you know your goals and what’s out there, choose the technologies that best fit your needs. This might be blockchain for secure transactions, AI for personalized services, or something else entirely—if that is the case let us know about it.

Form Strategic Partnerships: The tech world is vast, and not every solution fits your needs. EBS Integrator and Oobit teamed up to create an app that lets people use cryptocurrency at over 100 million stores worldwide. This successful partnership, with 10,000 users and strong market support, shows how the right tech ally can solve tough challenges and make digital payments easier for businesses and more. It's all about finding partners who know tech and can get people excited about new solutions.

Focus on Customer Experience: The end goal of FinTech is to better serve your customers. Make sure the technology you adopt enhances their experience with your services in terms of accessibility, convenience, and personalization.

Testing and Feedback: Before fully launching a new FinTech solution, test it with a small group of customers. This can help you catch any issues early and adjust based on real feedback.

Stay Compliant and Secure: As you adopt new technologies, keep up with financial regulations and invest in cybersecurity. Protecting your customers' data is crucial for maintaining their trust.

Educate Your Team: Ensure your team understands how to use the new technologies. Ongoing training can help them stay on top of changes and provide better service to your customers.

Evaluate and Adjust: Regularly review how well the FinTech solutions are helping you meet your goals. Be ready to make changes based on performance data and customer feedback.

Take control of the future with FinTech

The future of finance is about embracing technology. It's about creating a new way of using money that's faster, safer and works for everyone. With technologies like blockchain for security, AI for smarter services and digital payments for convenience, the possibilities are endless.

But it's not just about new gadgets. It's about changing the way we think, and preparing for a world where finance is digital first. Those at the forefront of the financial industry need to embrace FinTech now - not just to keep their businesses afloat, but to help them thrive.

What's more, FinTech is leading us to a future where financial services are more accessible and convenient, creating a better system for everyone. The time to start is now - let's not just watch the future unfold, let's create it with FinTech.

Share this article on:

Sign up for our newsletter

Be up-to-date with our latest news, in-depth insights, and privileged content.

Related articles

Digital Transformation

Technology

Companies involved in the movement of goods and the management of logistics are undergoing major changes to keep up with the demands of today's customers and the rapid pace of change in the marketplace. What they're doing is making extensive use of digital technologies - that is, using computers, the Internet and other digital tools not just to improve the way they work, but to fundamentally change the way they operate, interact with customers and run their businesses.

18 Mar 2024

Technology

IT Consulting

Digital Transformation

Retail in 2024 is set for a technological leap, driven by the industry's need to respond to growing consumer demands. As market saturation, rising consumer expectations, globalisation, cost reduction, sustainability and regulatory compliance pressures increase, the need for retailers to become more technologically advanced has become even more apparent.

01 Mar 2024

Technology

News

2023 was a year of major technological advances around the world that not only offered hope for a better future but began to make it a reality. Technology has advanced significantly in areas such as AI, quantum computing, AR/VR and environmental technology.

27 Feb 2024